Recommendation Info About How To Become A Cpa In Texas

Save on a bs business w/ flexpath.

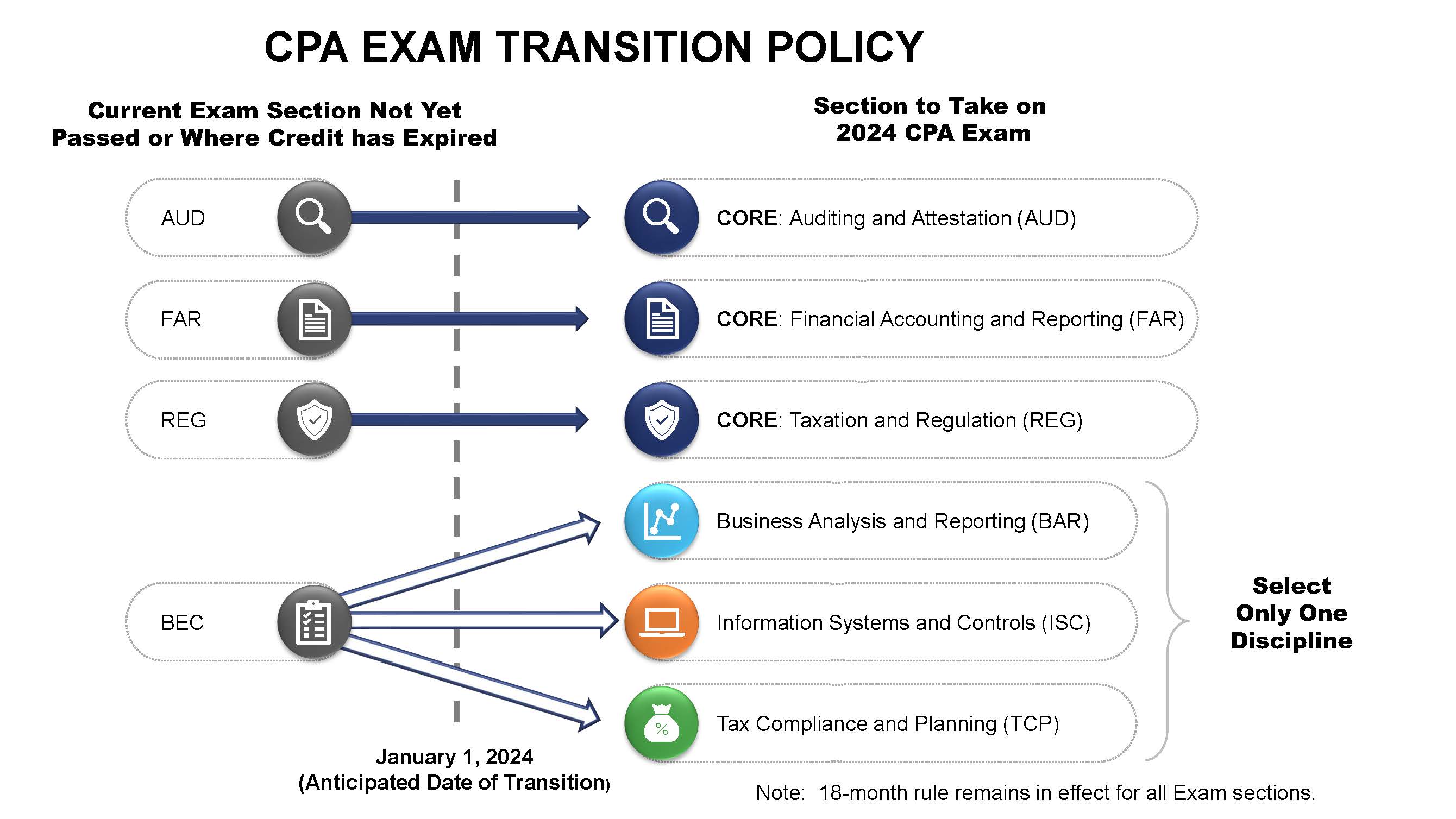

How to become a cpa in texas. File an application for issuance of the cpa certificate. In order to be eligible to sit for the exam in texas, candidates must meet the following. To be eligible for licensure, cpa candidates are required to earn at least 150 semester hours of college credit within a bachelor’s degree program or higher before passing.

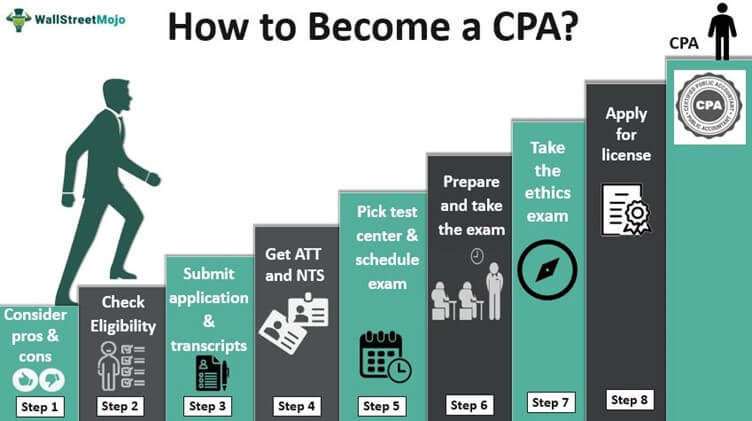

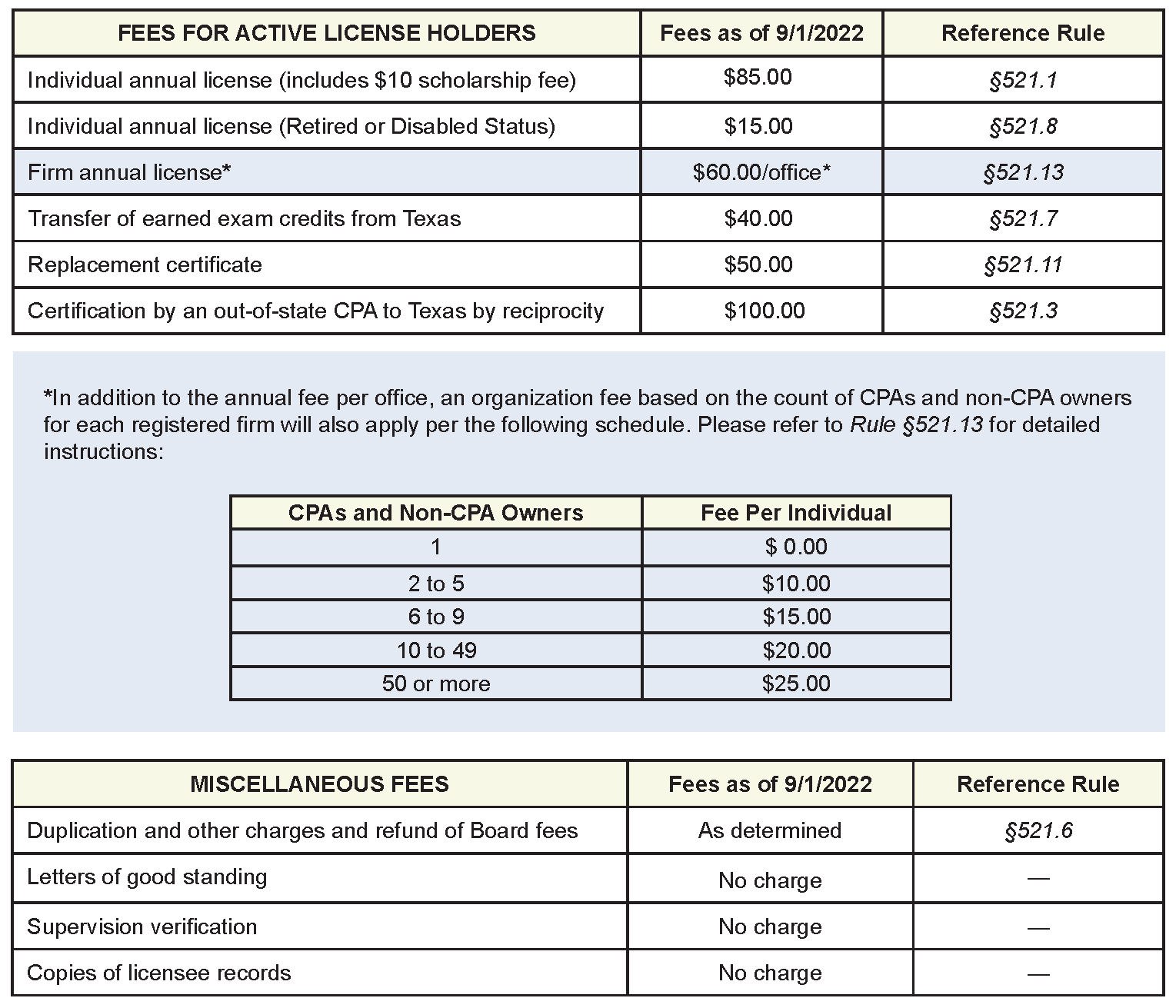

How to become a licensed cpa in texas texas cpa exam requirements. Here are the steps to become a licensed cpa in texas: As a cpa certificate holder in texas, you must complete continuing professional education (cpe) hours to maintain your cpa certificate.

This online program will equip you with the knowledge and direction you need on the journey to obtaining a texas cpa license. During the course of applying to the board to take the cpa examination and to become a texas cpa you will be required to provide information about yourself. Must pass a background check.

Steps to become a cpa in texas? To meet the texas cpa education requirements to sit for the cpa exam, you’ll need a bachelor’s degree. This webcast was held feb.

You must meet the following qualifications to take the cpa exam. Pass an exam on the board's rules of professional conduct which will be emailed to you after you submit the application for. Request free info from schools and choose the one that's right for you.

Ad find colleges & universities that prepare you to become a cpa. Electronic fingerprinting and background check. Pace & price vary—fees apply.

![Texas Cpa Exam And License Requirements [2022]](https://cdn.wallstreetmojo.com/wp-content/uploads/2021/11/Texas-CPA-Requirements.jpg)

![Texas Cpa Exam And License Requirements [2022]](https://cdn.wallstreetmojo.com/wp-content/uploads/2021/11/Texas-CPA-Examination-Process.jpg)

![Texas Cpa Exam & License Requirements [2022] - Cpa Clarity](https://cpaclarity.com/wp-content/uploads/2021/06/cpa-requirements-texas.jpg)

![Texas Cpa Requirements - [ 2022 Tx Cpa Exam & License Guide ] -](https://www.number2.com/wp-content/uploads/2022/04/texas-cpa-exam-requirements.jpg)

![How To Pass The Cpa Exam & Become A Certified Public Accountant [10-Step Plan] - Beat The Cpa! 2022](https://beatthecpa.com/wp-content/uploads/2017/11/Accounting-Career-Salaries-Infographic.jpg)

![Texas Cpa Exam And License Requirements [2022]](https://cdn.wallstreetmojo.com/wp-content/uploads/2021/11/Experience-Requirements.jpg)

![Texas Cpa Exam And License Requirements [2022]](https://cdn.wallstreetmojo.com/wp-content/uploads/2021/11/Texas-CPA-Exam-License-Requirements.jpg)